Understanding gross leases in real estate simplifies relationships by having tenants cover all-inclusive fixed rent, including maintenance and utilities. Popular in commercial spaces, this structure provides stability, clear financial management, reduces disputes, and fosters mutually beneficial agreements through efficient property management. Essential for investors seeking optimal returns and long-term partnerships in a competitive market.

In the dynamic landscape of real estate, understanding gross lease structures is pivotal for investors and tenants alike. This comprehensive guide dives into the intricate details of gross leases, focusing on how they encompass total expenses. By unraveling the components that make up these agreements, we empower readers to navigate lease setups strategically, maximizing returns in an ever-evolving market. Discover key insights into real estate leasing, from defining terms to securing favorable outcomes.

Understanding Gross Lease Structure in Real Estate

In real estate, a gross lease is a type of agreement where the tenant pays a fixed amount, known as rent, to the landlord covering all expenses associated with the property. This includes not just the typical costs like maintenance and repairs, but also significant expenses such as taxes, insurance, and even utilities. The key advantage for tenants is simplicity; they pay a single, predictable figure without having to worry about splitting bills or negotiating individual costs. For landlords, it provides a steady income stream with all expenses bundled into the lease agreement.

This structure is particularly popular in commercial real estate where businesses seek stability and predictability in their overhead costs. It simplifies operations for both parties, streamlining financial management and reducing potential disputes over expense allocation. Understanding gross leases is crucial for anyone involved in the real estate market, as it offers a clear framework that can facilitate efficient property management and mutually beneficial agreements.

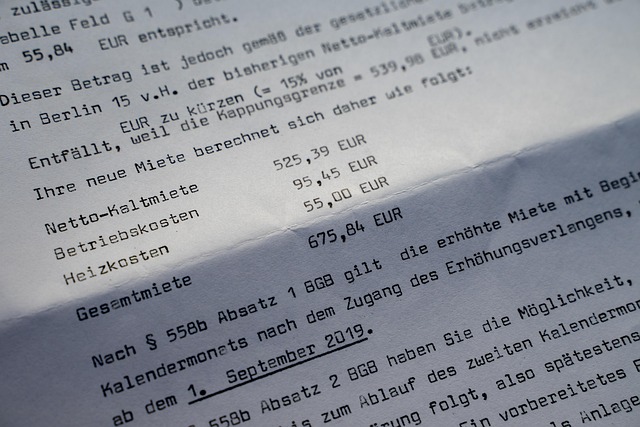

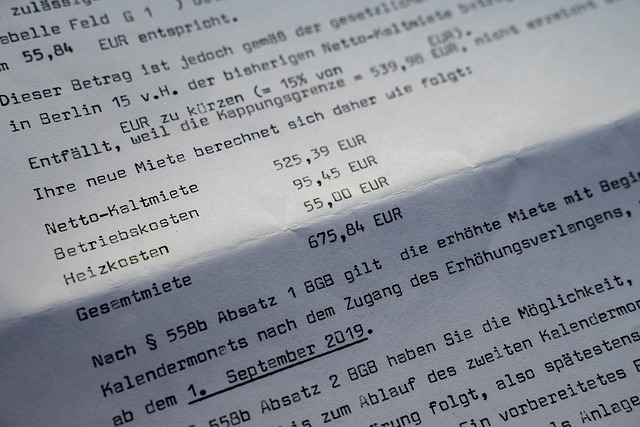

Total Expenses: A Comprehensive Breakdown

In the realm of real estate, understanding gross lease and its total expenses is paramount for both landlords and tenants. The gross lease, as the name suggests, covers all costs associated with a property, leaving no surprises in the financial arena. This comprehensive arrangement includes not just the standard rent but also a detailed breakdown of various expenses.

Total expenses under a gross lease typically encompass a wide range of items, such as property taxes, insurance, maintenance costs, common area charges, and even utilities. Each component is transparently accounted for, allowing both parties to have a clear picture of their financial obligations. This clarity is particularly beneficial in the dynamic world of real estate, where budgeting and forecasting accurately can make or break the success of an investment or tenancy.

Navigating Lease Agreements for Optimal Returns

Navigating lease agreements is a critical aspect of real estate investments, offering both opportunities and challenges. For investors seeking optimal returns, understanding the gross lease concept is essential. This approach ensures that the lessor covers all expenses related to the property, from maintenance and taxes to insurance and utilities. By doing so, tenants can focus on generating revenue without the burden of managing these costs.

Such agreements provide a clear framework for both parties, fostering transparency and long-term partnerships. In the competitive real estate market, this strategy can be a game-changer, attracting tenants who value predictability and simplicity in their operational expenses. It’s not just about saving money; it’s about empowering businesses to thrive by removing financial complexities and enhancing overall tenant satisfaction.