Triple Net (NNN) leasing in real estate shifts all property expenses to tenants, benefiting both sides with predictable costs and reduced management for investors, while providing tenants with transparency. This model, popular for commercial spaces, simplifies property management and offers long-term stability. However, successful NNN investing demands thorough tenant screening and understanding local markets to ensure profitability.

“In the world of real estate, understanding ‘triple net’ lease agreements is a game-changer. This comprehensive guide delves into what sets triple net leasing apart from traditional models, offering a detailed overview for investors. From covering all outlays—from property taxes to maintenance—to its benefits and potential drawbacks, this article navigates the intricacies. Whether you’re an experienced investor or new to real estate, understanding triple net can revolutionize your approach, ensuring informed decisions in today’s dynamic market.”

Understanding Triple Net: A Comprehensive Overview

In the realm of real estate, Triple Net (NNN) stands as a unique and comprehensive model that allocates all outlays related to a property to the tenant. This concept is particularly significant for investors and businesses seeking a clear understanding of their operational costs. NNN properties are typically commercial spaces, such as retail units or office spaces, where the landlord’s responsibilities are limited to structural maintenance and major repairs.

This arrangement offers tenants transparency and predictability in their rental expenses, as they are responsible for all other costs, including utilities, insurance, and property taxes. In essence, NNN leasing is a win-win situation, streamlining operational processes for tenants while providing investors with a steady income stream. This model has gained popularity due to its ability to simplify property management and offer long-term financial stability in the ever-evolving real estate landscape.

How It Differs from Traditional Lease Agreements

In the world of real estate, lease agreements have traditionally been a straightforward arrangement between a landlord and tenant, with clear definitions of rent, responsibilities, and terms. However, “Triple Net” lease agreements introduce a unique twist, significantly differing from conventional practices. This innovative approach expands the scope of obligations for both parties, ensuring a comprehensive coverage of all expenses related to the property.

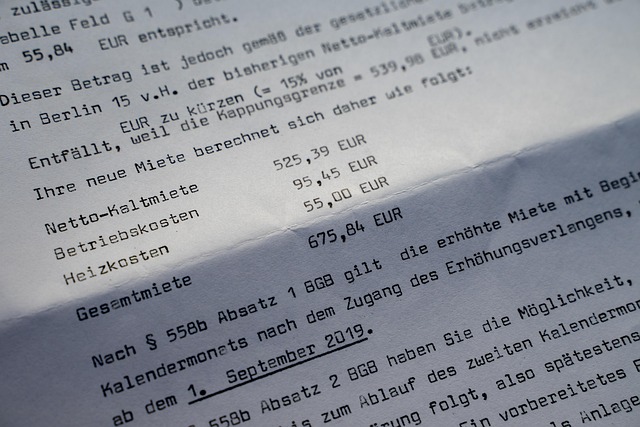

Unlike traditional leases that often leave certain outlays untouched, Triple Net (NNN) leases obligate tenants to cover not only standard rent but also property taxes and insurance—three key aspects typically denoted by the “net” term. This shift in responsibility can be seen as a game-changer for landlords, who benefit from reduced financial burden, while tenants must be prepared for potentially higher upfront costs. Such agreements are particularly relevant in today’s dynamic real estate market, where transparency and clarity in lease terms are increasingly valued.

Benefits and Considerations for Real Estate Investors

For real estate investors, understanding “triple net” (NNN) can unlock significant benefits. This structure, where a tenant covers all outlays including taxes, insurance, and maintenance, shifts a substantial portion of operational responsibilities—and costs—off the investor’s shoulders. This not only simplifies property management but also enhances cash flow predictability, as rent payments typically cover all expenses related to the property. In today’s competitive real estate landscape, this approach can provide investors with a competitive edge, especially in attracting long-term tenants seeking stable and transparent operational models.

However, considerations are crucial before diving into triple net. Investors must meticulously vet potential tenants capable of assuming these extensive obligations. Additionally, assessing the local market dynamics and property values is essential to ensure the investment’s longevity and profitability. While triple net offers advantages in terms of reduced management burdens and improved cash flow, it requires a nuanced understanding of legal agreements and financial responsibilities to make informed decisions that align with long-term goals within the real estate sector.