"Triple Net (TN) leases are transforming real estate, offering a comprehensive cost management structure where tenants cover taxes, insurance, and maintenance, contrasting traditional leases. This transparency benefits both parties: tenants with predictable expenses and landlords with steady income. Popular in commercial properties, TN leases foster trust, stability, and efficiency, ensuring fair terms through regular rental rate reviews. Understanding NNN structures is crucial for investors and property managers in today's competitive real estate market."

“Unraveling the complexities of triple net leasing in real estate offers a powerful financial strategy for property owners and tenants alike. This comprehensive guide aims to demystify this arrangement, providing insights into its structural advantages. From rent covering all outlays, including taxes and insurance, to streamlining operational costs, understanding triple net can revolutionize real estate management. We’ll explore the benefits, dissect common expenses, and offer a detailed overview for both property owners seeking efficient leasing models and tenants wanting cost-transparent agreements.”

Understanding Triple Net: A Comprehensive Overview in Real Estate

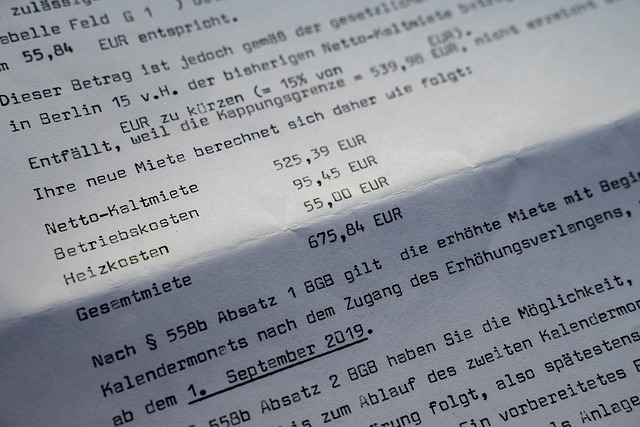

In the world of real estate, understanding lease terms is paramount for investors and tenants alike. One such term gaining traction is “Triple Net” (TN), a comprehensive arrangement that simplifies cost management. Triple Net often covers all outlays related to a property, including taxes, insurance, and maintenance—a significant departure from traditional leases. This concept is especially appealing in the commercial real estate sector, where operational expenses can vary widely.

By agreeing to a Triple Net lease, tenants benefit from predetermined and included costs, eliminating surprises on their monthly statements. For landlords, it provides a steady income stream with all essential property-related expenses factored in. This transparency fosters trust and long-term relationships between tenants and landlords, contributing to the overall stability and efficiency of real estate transactions.

The Financial Benefits of Triple Net for Property Owners and Tenants

For property owners, triple net offers a streamlined financial model that simplifies their responsibilities. In a traditional lease agreement, landlords typically cover property taxes and insurance, while tenants are responsible for maintenance and repairs. Triple net shifts this burden entirely to the tenant, providing landlords with predictable cash flow and reduced administrative tasks. This structure is particularly advantageous in real estate investments, as it allows owners to focus on asset management and maximizing returns without the complexities of managing operational expenses.

Tenants also benefit from triple net arrangements by gaining clarity and control over their outlays. By taking on all costs associated with the property, tenants can better budget and predict their expenses. This transparency is essential in a competitive real estate market, where businesses seek cost-effective solutions. Moreover, triple net leases often include regular reviews of rental rates, ensuring that both parties benefit from fair and market-aligned terms over the lease period.

Common Expenses Included in the Triple Net Structure

In the real estate sector, understanding triple net (NNN) structures is crucial for investors and property managers alike. Triple net often covers all outlays, making it a popular choice for commercial properties. This structure typically includes a range of common expenses that are vital to consider before committing to a lease or investment. These can encompass property taxes, insurance costs, and most significantly, common area maintenance (CAM) charges.

CAM charges cover a broad spectrum of expenses related to the upkeep and operation of shared spaces within a real estate development. This may include janitorial services, landscaping, utilities such as water and electricity, and even security or surveillance systems. By including these costs in the triple net structure, tenants benefit from a transparent and comprehensive expense model, ensuring they cover all necessary outlays associated with the property’s operation and maintenance.